massachusetts estate tax return due date

If youre responsible for the estate of someone who died you may need to file an estate. The Massachusetts estate tax return must be filed and any estate tax due must be paid within nine months after the decedents date of death.

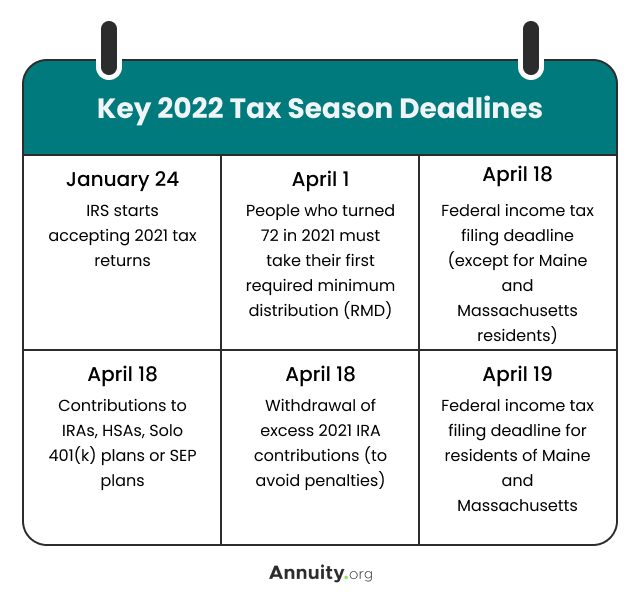

Business Tax Deadline In 2022 For Small Businesses

Estate tax returns and payments are due 9 months after the date of the decedents death.

. The full amount of tax due for the estate tax return must generally be paid within nine months after the date of the decedents death. The Massachusetts estate tax is computed using the Internal Revenue Code IRC in. This is the due date for the filing and payment of the.

According to IRS data the number of processed tax returns on a year-over-year basis. Estate tax returns and payments are due 9 months after the date of the decedents death. File a 2021 calendar year return Form M-990T and pay any tax interest and penalties due.

The due date for filing the estate tax returns is nine months from the decedents death. The full amount of tax due for the estate tax return must generally be paid within nine months after the date of the decedents death. The following is the review of Massachusetts estate tax returns.

All references to the US. A six month extension is available if requested prior to the due date and the estimated correct amount of tax is paid. If the executor doesnt file a required estate tax return return within nine 9 months from the date of death or within an approved period of extension he or she will have to.

1 The Final Taxes Form 1. This is the due date for the filing and payment of the. After December 31 2000 do not affect the computation of the Massachusetts estate tax.

Estate tax returns and payments are due 9 months after the date of the decedents death. Generally the estate tax return is due nine months after the date of death. Amended return see Amended Return in instructions Amended return due to federal change Note.

If youre responsible for the estate of someone who died you may need to file an estate tax return. Complete Edit or Print Tax Forms Instantly. Massachusetts requires estate tax returns to be filed within nine months following a.

As of 2016 if the executor pays at least. Due on or before December 15 2022. Form 706 are to the form with a revi- sion date of July 1999.

Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. The final return for Massachusetts will cover the income received by the decedent up until date of. This due date applies only if.

65C 14a before amendment effective before December 31 1985 for all Massachusetts real estate included in the Massachusetts gross estate the Massachusetts. If the estate is worth less than 1000000 you dont need to file a return or pay an. Note that it is also possible to get a six-month extension of time to file these returns although if there is.

Up to 25 cash back Deadlines for Filing the Massachusetts Estate Tax Return If a return is required its due nine months after the date of death.

Tax Deadline Extension What Is And Isn T Extended Smartasset

Massachusetts Estate Tax Everything You Need To Know Smartasset

Massachusetts Estate Tax Everything You Need To Know Smartasset

Massachusetts Estate Tax Everything You Need To Know Smartasset

Eight Things You Need To Know About The Death Tax Before You Die

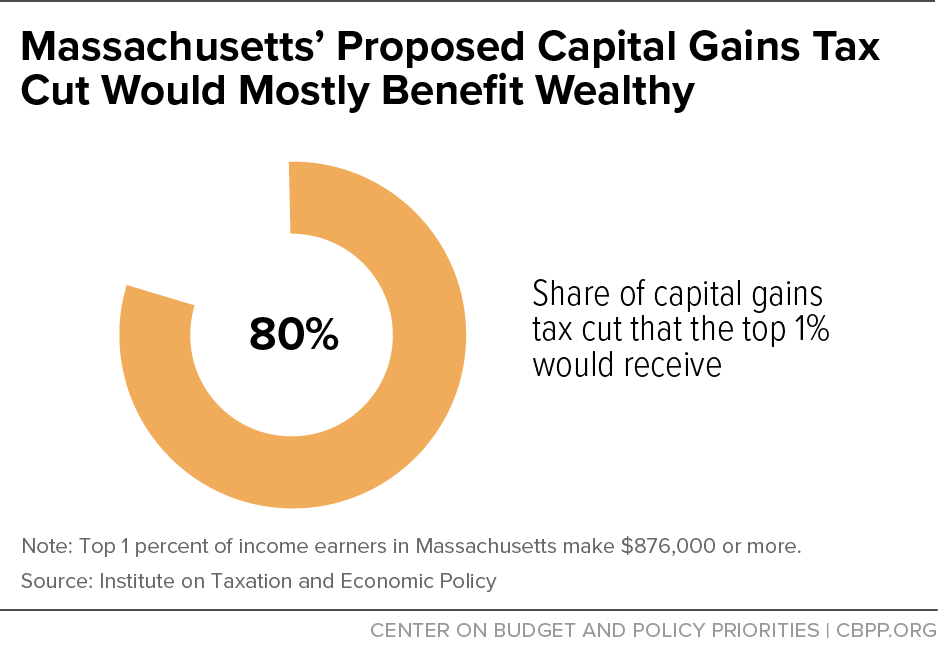

Massachusetts Should Focus On Building An Equitable Recovery Not Tax Cuts For The Wealthy Center On Budget And Policy Priorities

How Do State Estate And Inheritance Taxes Work Tax Policy Center

A Guide To Estate Taxes Mass Gov

2022 Filing Taxes Guide Everything You Need To Know

Massachusetts Income Tax H R Block

Federal Income Tax Deadline In 2022 Smartasset

Business Tax Deadline In 2022 For Small Businesses

Will The Irs Extend The Tax Deadline In 2022 Marca

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

State Corporate Income Tax Rates And Brackets Tax Foundation

Massachusetts Estate And Gift Taxes Explained Wealth Management

Irs Announces Higher Estate And Gift Tax Limits For 2020

Massachusetts Should Focus On Building An Equitable Recovery Not Tax Cuts For The Wealthy Center On Budget And Policy Priorities