how to decide on term life insurance

For some life insurance is a great tool to help them achieve their. How to Decide on Life Insurance Term Length - Hinerman Group High Risk Life Insurance Quotes You Can Trust.

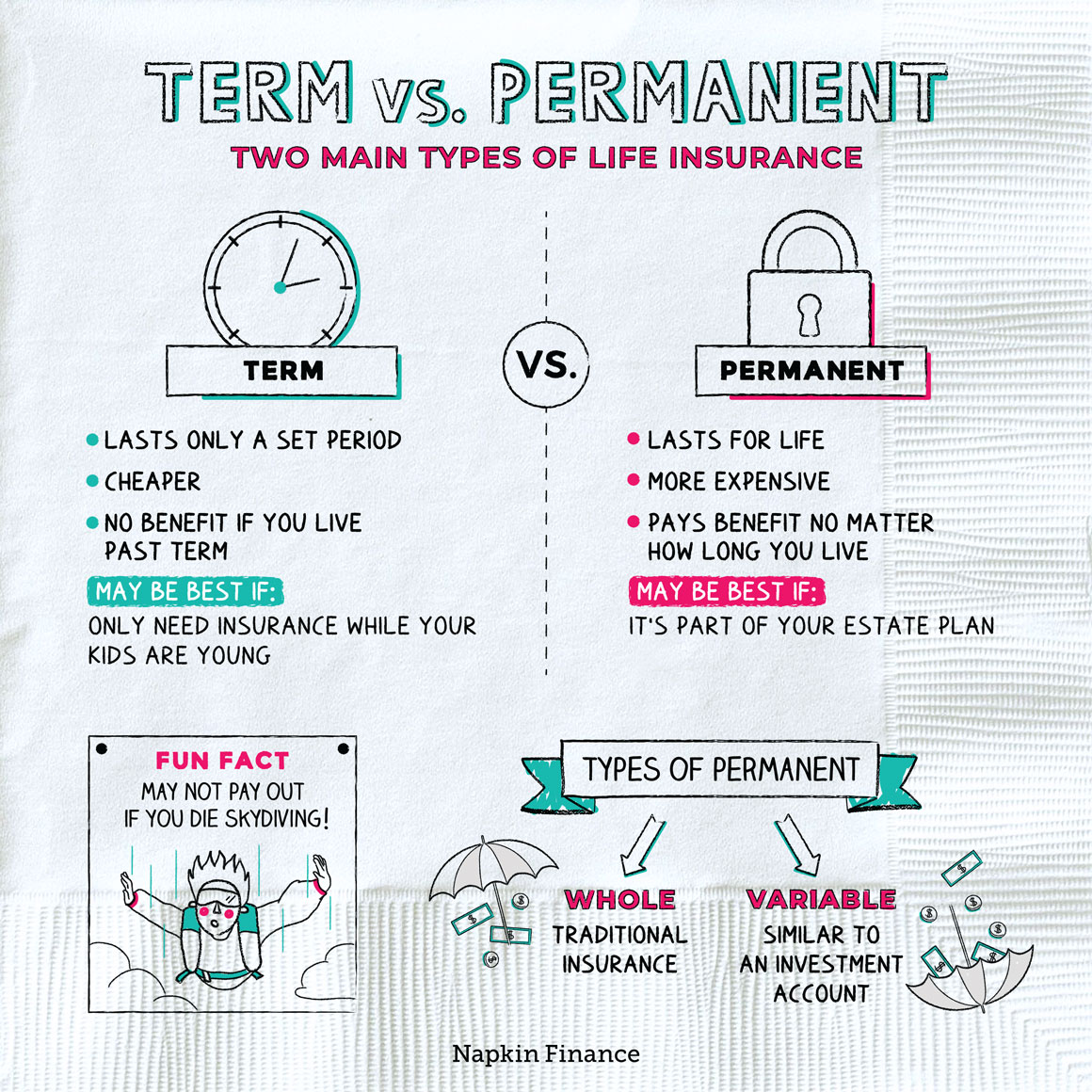

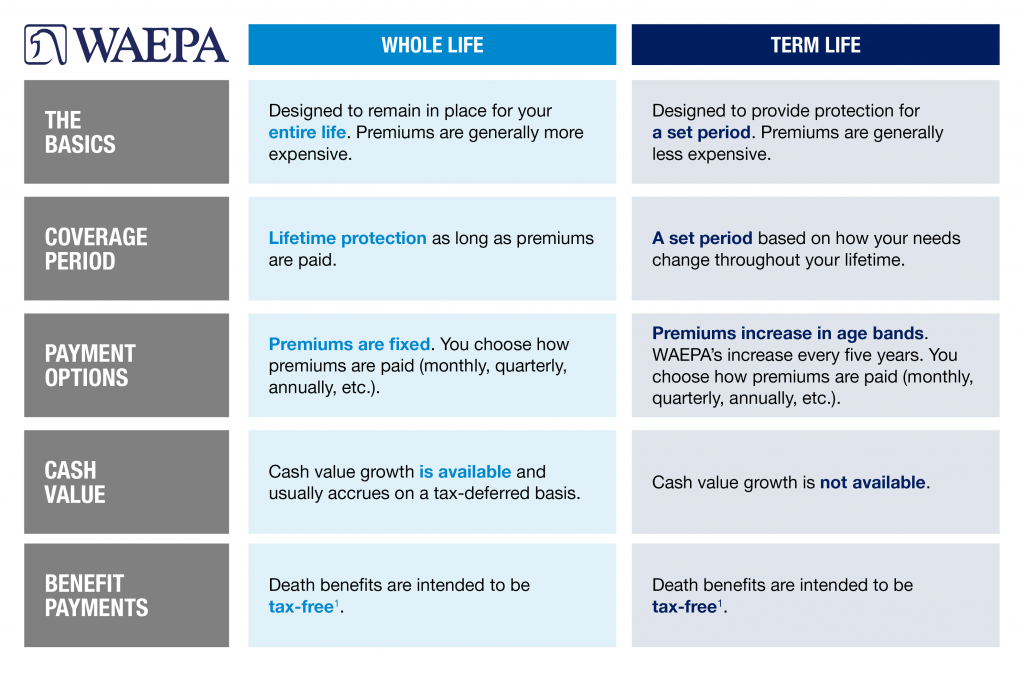

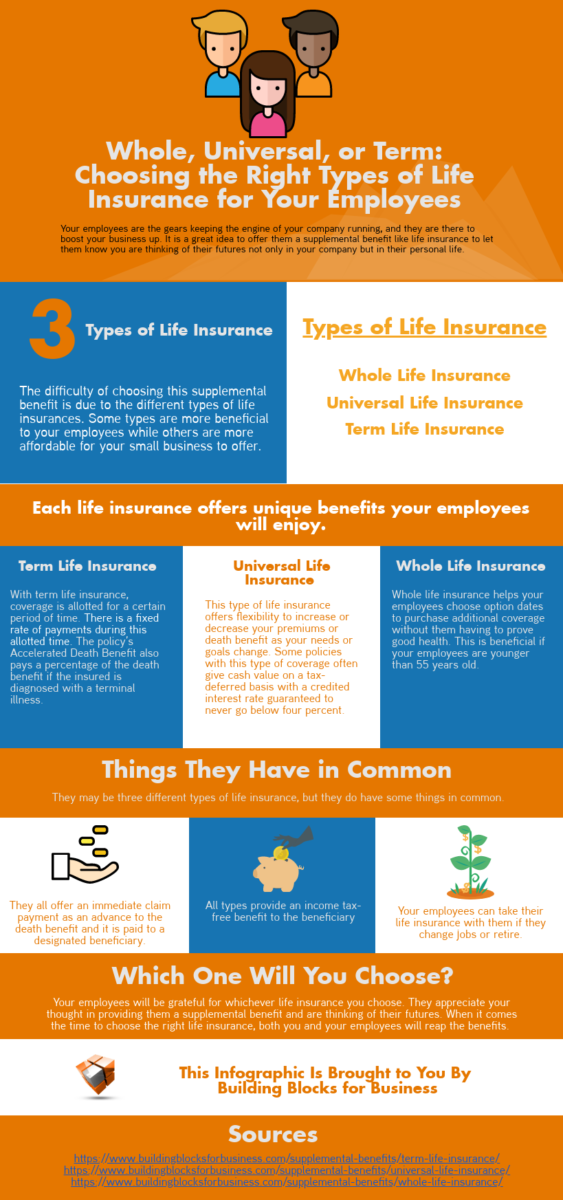

What Type Of Life Insurance Policy Do I Need

Term life insurance monthly premiums are less.

. Decide how much coverage you need. The factors to be considered while determining the policy term are. Consider Your Life Stage and Dependents.

1 Here are Quick 5 Critical Aspects Which You Must Consider Before You Buy any Term Life Insurance Policy. The longer the term obviously the higher the price. Many people ask us do I need life insurance in retirement.

When it comes to term life insurance the amount of coverage. Unless you are a multi-millionaire or the heir of a business magnet you need to be covered. Understand your income base and decide on the insurance cover based on that.

So buying a policy with a longer term length while youre a 20 or 30-year old means that youre. The length of a life insurance contract depends based on your financial requirements it could be 10 years 20. If the term life insurance policy.

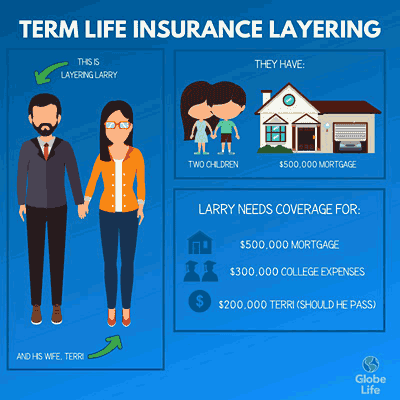

Also known as pure life insurance term life insurance is a type of policy that guarantees payment of a death benefit during a set term. Let your mortgage and other long-term debt determine the length of term life insurance you need. The primary step for learning how to choose term insurance is to assess your life when buying insurance.

How to Decide on Term Insurance Cover. Term policies are available for 10 15 20 25 30. The short answer is - maybe.

Below we cover key topics to learn how to compare term life insurance options. Based on the tenure the insurance company keeps on increasing your term insurance premium. Take for instance the premium rates of iProtect Smart term cover from ICICI.

If you survive the policy duration you will need to purchase another policy if you want to keep life. 11 Evaluate Your Insurance Need. Your premium price for a term life insurance is going to be cheaper than it is for a whole life policy.

Insurance premiums tend to go up the older you are when you buy a policy. Open 5 Days A Week - 800am - 500pm Free Consultation. When you secure a life coverage your.

You pay premiums until the expiry. Term life insurance is a policy that lasts for a specific period of time typically ranging from 10 20 or 30 years to specific ages. If you recently took a 20 years mortgage consider purchasing a 20 or 15.

You choose the term length and pay the premiums to keep the coverage. The premium of the policy. Life insurance is considered useful for death benefits which are tax-free to those.

Premiums Your age health history lifestyle the term length and the amount of coverage you want will affect your premiums. 12 Choice of Single or Regular. How To Decide The Policy Term For a Life Insurance Plan.

Experts believe that there should be life insurance of 15-20.

Term Life Vs Whole Life Insurance Understanding The Difference

How To Buy Life Insurance In November 2022 Policygenius

10 20 Or 30 Years Choosing Term Life Insurance Length Bestow

What Life Insurance Term Length Is Right For You

How To Lower Your Life Insurance Premium

:max_bytes(150000):strip_icc()/dotdash-ask-answers-205-Final-7a1ca51b85d44e0d81dc7b46f919180d.jpg)

Term Vs Universal Life Insurance What S The Difference

Life Insurance Consulting Advice Los Angeles

Term Life Vs Whole Life Insurance Moneyunder30

When Whole Life Insurance Is Better Than Term Life Insurance With 10 Real World Examples

Is Your Term Life Insurance Rate Locked In 2022

Layering Term Life Insurance Could Save You Money Globe Life

What Is Term Life Insurance Coverage And Premiums Explained Cnn Underscored

Choosing A Life Insurance Term Length

Whole Universal Or Term Choosing The Right Types Of Life Insurance For Your Employees Infographic Building Blocks

Life Insurance Education Catholic Financial Life

Decreasing Term Life Insurance Life Insurance Glossary Definition Sproutt

Top Pro Tips To Getting The Best 30 Year Term Life Insurance Program